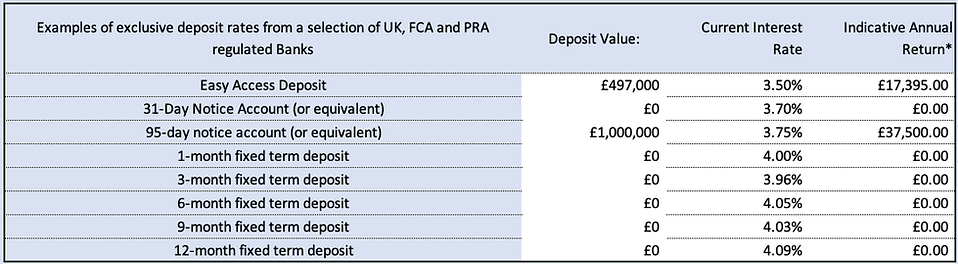

A small example of some of the best deposit account interest rates for your Multi Academy Trust, School or Charity

If you are an Academy (SAT or MAT), we offer guidance, support and help with your deposit strategy without charge.

You receive 25% of your first years Insignis fees back as a rebate to your Academy or School Bank Account*

A small sample of example Deposit Interest Rates from more than 100 accounts available for Schools, Academies and Charities

Correct as of 6th January 2026

This is designed as a guide only. All calculations should be manually checked for accuracy.

Returns shown assume interest rates do not change and funds are left for 12-months in total and exclude any potential compound interest.

Finding the best deposit account interest rates for your school, MAT or Charity is hard

It is time consuming and not every bank will want your deposits.

It can then take weeks or months to set up the account.

This is where we come in. We make the process easy for you.

You can open your deposit accounts without providing ID to each different bank and without completing an application form for each bank by using an FCA registered Deposit Platform.

How do you access the best deposit accounts for your school or charity?

-

Choose your deposit platform (make sure it is FCA registered, holds the money in your name to ensure you retain ownership of the funds and ensure it offers you dual control if needed (we recommend this so deposits and withdrawals are checked by a second person))

-

Set up your deposit platform (a simple form that does not to be signed by every Trustee)

-

You will then have a 'hub' account that you transfer money to from your existing current account and where withdrawals go through back to your existing current account (Most hub accounts are set up so withdrawals can only go back to your bank account ensuring no one can request a withdrawal to a different account)

-

Fund your Hub account with a BACS, CHAPS or Faster Payment transfer from your existing bank

-

Choose which banks and which accounts you want to place the deposits with (remember, there are no further application forms or ID to provide).

-

Enjoy easy access and easy operation of all the deposit accounts under a single, on-line banking platform.

We have compared many deposit platform providers and have partnered with Insignis, the provider with the best combination of Banks, Security and fees for the education and not for profit sectors.

The Insignis Deposit Platform is approved by the DfE. It is the only platform that they have approved.

Our on-going support and services are completely free of charge for Academies and we ensure your fees are never more than if you go directly to them.

* 25% of your Insignis fees from the date of opening for 12-months will be rebated to you.

Your fees are refunded quarterly in arrears to your main Trust bank account.

The refund is only eligible for accounts that we introduce to Insignis as we receive a fee share from them that we use to offer you this rebate.

Your fees are identical whether you go directly to Insignis or enjoy the additional complimentary services we provide you.

This offer is available to all Schools and Academies that do not already use the Insignis platform that apply for the Insignis deposit platform from the 1st February 2026.